The American Debt Ceiling: Playing Politics with the Global Economy

A potentially catastrophic debt default threatens the United States. Meanwhile, the two major American Political Parties continue to use the country’s self-imposed debt limit as nothing more than a political tool. American Treasury Secretary, Janet Yellen, has stated that Congress must raise the debt limit by 18th October in order to avoid the economic disaster the US is rapidly heading towards.

On Wednesday 29th September, the US House of Representatives raised the debt ceiling after weeks of debate and posturing. However, as the bill progresses to the evenly divided Senate, where Democrats have a slim majority by virtue of the Vice President’s tie-breaking power, the Republicans (GOP) have shut down any hope by requiring 60 votes for it to pass. Senate Majority Leader, Chuck Schumer, (DNY) attempted to move the bill forward with a simple majority vote, which Minority Leader Mitch McConnell (RKY) swiftly blocked.

That the Americans find themselves in this predicament is a result of the political red tape that has led to decades of animosity. The debt ceiling, or limit, is a cap that Congress has imposed on the amount that the US government can borrow; it currently stands at $28.4 trillion, while the debt stands at $28.8 million as of the 5th October. The US generally runs budget deficits, which means that they spend more than they take in through taxes and other revenue. The extreme debt comes from the US’ financial obligations, including social security programs, the price of the globe’s most expensive military, and interest payments, which only require the country to borrow millions more. In spite of the debt ceiling nothing prevents Congress from approving expenditures that will result in the government exceeding it, which requires them to address raising the limit later. Congress has raised or suspended the limit 78 times since 1960, including three times during the Trump administration. This would be the first time that the US has failed to raise its debt limit in time, which would result in a ‘catastrophic’ default on its debt, according to the Treasury.

The debt ceiling exists to mitigate the cost of borrowing for taxpayers and future citizens. However, when the debt ceiling is raised, the boundary may not be as clear as it appears. US federal debt was about 33% of GDP in 2000, but in 2021, it is almost 100%. Even in other places, the debt ceiling is not strict enough to be effective. In the European Union, for example, states must cap their debt at 60% of GDP, which is mostly ignored; the average EU debt level is greater than 90% GDP. Almost universally throughout economic academia, there are doubts about the efficacy of debt limits in the first place. Borrowing levels have broken debt limits yet economies continue to function, and most countries have conducted successful economic policy without a debt limit at all, including Sweden, Germany, and Canada. Many economists raise questions about whether the limits are purely arbitrary.

Technically, the US government has already run out of money; since July, Yellen says, the Treasury has been taking ‘extraordinary measures’, including curbing some government investments so that they can continue paying the bills. Yellen says that the government must raise the debt limit by 18th October, but this date is more of an estimation- the substantial sum of money that the government has spent on pandemic relief makes it even more difficult to predict.

Since a US default has never happened before, any assessments of its potential damage are simply educated guesswork. In an address to the Senate Banking Committee, Yellen declared that the “full faith and credit of the United States would be impaired, and our country would likely face a financial crisis and economic recession”. This impact could last for years. ‘Moody’s Analytics’ warns of the risk of 6 million jobs lost, an unemployment rate of 9%, and a 4% decline in economic activity. Professor Menzie Chinn of the University of Wisconsin warns of the “valuation of US Treasury debt going down”, or that interest rates will rise for US borrowing. A default would also mean that many federal employees and those who rely on federal programs (military members, government workers, and those who depend on social security or food assistance) would not be paid.

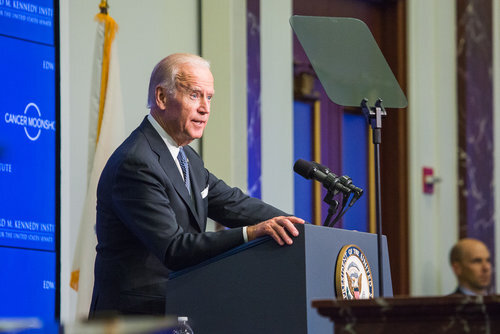

It is hard to say whose responsibility this is. While Republicans insist that the US has hit its limit due to President Joe Biden’s initiatives, Democrats are convinced that the exorbitant spending was actually due to former President, Donald Trump’s, policies that are just now catching up with the treasury, including major tax cuts in 2017. It is likely that it is a combination of these two things; Trump’s tax cuts are estimated to have added $1.8 trillion to the country’s debt, while Biden’s COVID-19 relief bills could have added up to $1.9 trillion; Democrats generally agree that this is a bipartisan issue.

Image Courtesy of woodley wonderworks via WikiMedia Commons © 2008, some rights reserved.